2022 was a tough year for global economies. China’s zero-Covid stance continued to hamper growth for countries struggling to emerge from the pandemic. Meanwhile, rising inflation and the cost of living crisis was exacerbated by Russia’s decision to invade Ukraine.

And then, in September, came the government’s “mini-Budget”. The markets reacted badly to “Trussonomics”, sending foreign investors scarpering and the value of the pound against the dollar plummeting to its lowest level since UK decimalisation.

Movements in the stock market reflected some of the year’s headline events but also proved an oft-used adage that the stock market is not the economy.

If you have long-term investments, there are some valuable lessons to be learnt from this year.

Here are just three of them.

1. The markets hate uncertainty

A brief look at the FTSE 100 for the year reveals a potted history of global events and UK political upheaval.

Source: London Stock Exchange

Short-term dips coincide with:

- Russia’s invasion of Ukraine in late February

- The scandals that rocked Boris Johnson’s administration in July (leading to a record-breaking mass resignation of ministers and one sacking)

- Market fallout from the £45 billion of unfunded tax cuts announced in Kwasi Kwarteng’s mini-Budget in late September.

Global and domestic events will have a daily effect on stock market prices. This means that short-term periods of volatility are to be expected and it is for this reason that investing should always be a long-term proposition.

2. Focusing on your long-term goals is key

Investment is a long-term proposition, aligned with a specific long-term goal. When the market dips, staying focussed on your investment’s ultimate aim is vital.

If your goal hasn’t changed, your plan doesn’t need to either.

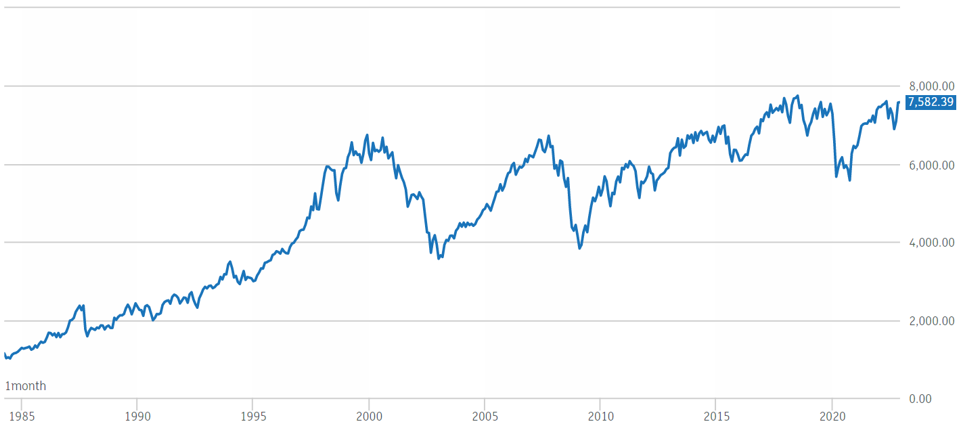

During the market turmoil of 2022, there might have been numerous occasions when you felt tempted to disinvest. But the general trend of the markets is upward, as the FTSE 100 over the last 30 years shows.

While the March 2020 dip resulting from the coronavirus pandemic is clear, the effects of this year’s political turmoil become short-term blips.

Despite huge global events like the financial crisis of 2008 and the war in Iraq in 2003, the upward trend is clear.

Source: London Stock Exchange

This means that selling stocks when prices are low means missing out on the rising prices that follow.

An investment period of 5 to 10 years or more gives your investment plenty of time to recover from short-term dips.

The key is to ignore the “noise”, keep patient, and stay calm.

Remember too that a successful investment allows you to achieve your goal, within your desired time frame, while taking as little risk as possible. That means keeping your money invested, avoiding the temptation to follow the markets daily, or chasing trends that “promise” huge returns at massive risk.

3. Embracing diversification spreads investment risk

In the same way that the economy is not the stock market, your investment isn’t the FTSE 100.

Although we have looked at the effect of the year’s events on the particular index, you won’t find those fluctuations exactly mirrored in your portfolio. To put it another way, a 5% drop in the FTSE 100 won’t necessarily equate to a 5% drop in your portfolio value.

This is because of diversification.

Based on the same principle as not putting all your eggs in one basket, diversification is a way of spreading investment risk. You’ll find diversification in all of Hartsfield’s portfolios.

Different asset classes, sectors, and geographical regions will have their own levels of risk attached and will react in different ways to global events.

For this reason, your portfolio will comprise a mixture of lower-risk government-issued bonds and higher-risk stock. Investments are also diversified across sectors and different regions, further spreading your risk exposure.

The hope is that an inevitable dip in one part of your portfolio will be offset by a rise in another.

Get in touch

While the last 12 months have been turbulent for the economy, it’s important to remember that markets have their own concerns. Indexes like the FTSE 100 are made up of huge companies and giant corporations, and shares remain an attractive investment proposition, even when times are hard.

Staying calm, staying invested, and ignoring the noise are key to your investment success. The general trend of markets is upward and that means that focusing on your long-term goals is key. If they haven’t changed, your investment plans don’t need to either.

If you have any concerns about the effect of the global economy on your investments, please get in touch and find out how our team of expert planners can help.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Planning

Planning Trustee

Trustee